The Prime Minister has now ordered the closure of public premises to help prevent the spread of Coronavirus.

The following premises that are now closed:

- Shops (apart from food stores and chemists)

- Pubs

- Cafes

- Restaurants

- Bars

- Leisure centres

- Theatres

- Gyms

Please note that this is under constant review and premises serving food can continue with take-out services.

How to Access Help in the Vale

NEW 27TH April** Today, the Chancellor has announced a new coronavirus loan scheme. A simple, quick, easy solution for those in need of smaller loans.

Businesses can apply for new Bounce Back Loans up to a maximum of £50,000, or 25% of turnover, with the government paying the interest for the first 12 months.

These loans will be available from 9am next Monday and there will be no forward-looking tests of business viability; no complex eligibility criteria; just a simple, quick, standard form for businesses to fill in.

For most firms, loans should arrive within 24 hours of approval and he has decided, for this specific scheme, that the government will support lending by guaranteeing 100% of the loan.

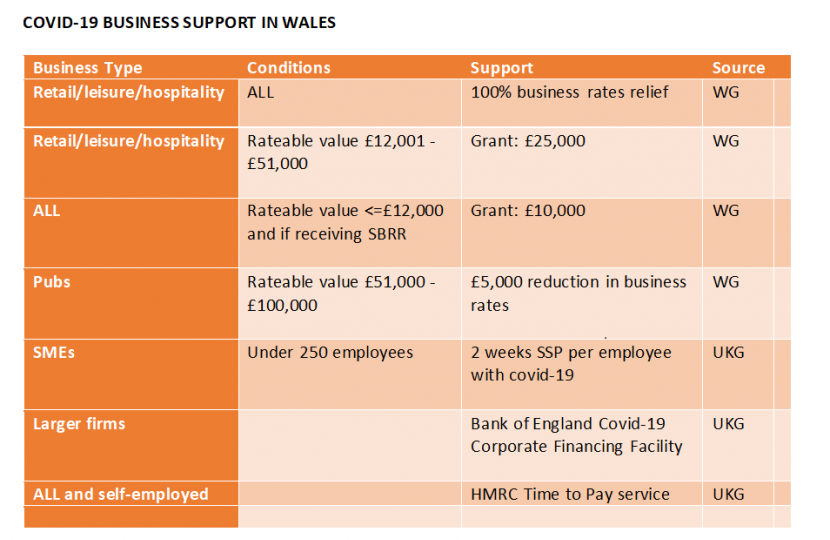

Many businesses in the Vale will be eligible for a 100% cut in their business rates.

The Council will write to all business in the Vale to request information that proves occupation or ownership. Once processed, they can benefit from having the business rate relief applied.

The most efficient way to apply for a grant is via: https://forms.valeofglamorgan.gov.uk/en/businessgrants

Regular updates will be posted by the Vale Council here: https://www.valeofglamorgan.gov.uk/en/working/Business-Support/Coronavirus-Advice-for-Business.aspx

Coronavirus Job Retention Scheme

The Chancellor announced an unprecedented response, with one of most comprehensive packages of economic support in the world. This included the Government providing direct support with the payment of wages through the Coronavirus Job Retention Scheme. This is a HMRC grant which can be used to pay the wages of staff who can no longer work due to Coronavirus, preventing their employers from taking the difficult and heart breaking decision to lay them off.

The Chancellor announced:

- A HMRC Grant which will cover at least 80% of wages up to the value of £2,500

- An increase in the basic rate of Universal Credit by £1000

- £7 billion of extra support through the welfare system

- Loans will be made available from Monday and will be interest-free for 12 months

As this package of support has only just been announced, further information will be included soon.

Find out if you're eligible

Find out if your employer is eligible, and how much your employer can claim if they're unable to operate or have no work for you to do because of coronavirus.

- Check if you’re eligible

- How much you’ll get

- While you’re on furlough

- If you do not want to go on furlough

More information here - https://www.gov.uk/guidance/check-if-you-could-be-covered-by-the-coronavirus-job-retention-scheme

Other Measures in Place

Many pubs have been concerned about insurance pay outs. These will be valid if their insurance covers pandemics. However, others may be eligible for a new £25,000 cash grant for businesses with a rateable value up to £51,000.

In the Budget the Chancellor announced, a major package of Government support as the first stage, including:

- 100% cut in business rates for every single shop and pub.

- £330 billion of government-backed loans for businesses.

- £10,000 cash grant (increased from £3,000) which would support 700,000 of the smallest of businesses.

- Cover and refund of statutory sick pay.

- Statutory sick pay covering a wider group of people including the self-employed and potentially those on zero hour contracts.

- Support from DWP through access to benefits with the minimum income floor temporarily relaxed.

The contact for business support in Wales is www.businesswales.gov.wales

03000 603000

You can find more information on the measures taken to support businesses via the UK Government website: https://www.gov.uk/government/news/coronavirus-covid-19-guidance-for-employees-employers-and-businesses